Monday 17th July 2023, 5 pm – 9pm

5:00pm Mello welcome and keynote presentation by Fatima Iu of Polar Capital

5:30pm Company presentation by Windward

6:00pm Company presentation by FADEL

6:40pm Stephen Clapham presents Behind The Balance Sheet

7:00pm Company presentation by React plc

7:30pm Company presentation by NASCIT

8:10pm Research and Regulatory changes, Gareth Evans of Progressive

8:15pm Mello BASH with Damian Cannon and Paul Scott covering Renold (RNO) & Foresight Group (FSG)

Fatima Iu, Polar Capital Technology Fund, Polar Capital Technology Trust & Polar Capital Artificial Intelligence Fund

Fatima joined Polar Capital in April 2006. She is a fund manager on the Polar Capital Technology Fund, Polar Capital Technology Trust and Polar Capital Artificial Intelligence Fund. She is responsible for the coverage of European Technology, Global Security, Networking, Clean Energy and Medical Technology.

Prior to joining Polar, Fatima spent 18 months working at Citigroup Asset Management with a focus on consumer products and pharmaceuticals.

Company Presentation – FADEL

![]()

FADEL is an AIM listed, US headquartered leading developer of cloud based brand compliance and rights and royalty management software that works with some of the world’s leading licensors and licensees across media, entertainment, publishing, consumer brands and hi-tech/gaming companies.

The use of FADEL’s products spans across

(1) marketers and advertisers to accelerate campaign creation, eliminate content misuse and maximise asset reuse;

(2) finance teams to generate and precisely manage royalty calculations, statements and audit reports; and

(3) licensing professionals to identify licensing violations, optimise revenue and avoid over/under royalty payments

FADEL has two solutions, being IPM Suite and Brand Vision.

IPM Suite provides solutions for content and IP creators (licensors) and content and IP users (licensees). Its system is built on a highly scalable architecture. Its Customers have complex needs, with the IPM Suite software helping to manage and process complex contracts and licensing requirements.

Brand Vision is an integrated platform for Brand Compliance & Monitoring that includes Content Services, Digital Rights Management, AI-Powered Content Tracking, a Brand Monitor, and 100 million Ready-to-License Images. It helps marketers/licensees to accelerate their digital strategy by allowing them to manage large volumes of content and associated usage rights.

The Group has a customer-centric approach, with a significant amount of product development historically having been conducted in collaboration with its customers. Continuous technical innovation and an agile approach ensures the Group regularly rolls out new capabilities and product configurations.

The Group has a blue-chip customer base, with customers such as Pearson, L’Oréal, Hachette Livre and Marvel Entertainment. Its customers include some of the largest licensors who drive significant licensing revenue as well as three of the “big five” French publishers. Through IPM Suite, FADEL’s larger customers have achieved significant ROI from cost efficiencies and licensing revenue growth opportunities which are not available using legacy solutions. As a result, the Group has reported exceptionally low churn in customers using IPM Suite following the implementation phase, to date.

The Group’s solutions are highly scalable and help address some of the challenges companies face as a result of digital transformation, growing amounts of content and IP and complex licensing arrangements. Therefore, the Group is well positioned to capitalize on fundamental market growth and pursue its growth strategy of selling into new and existing geographies, growing existing industries, entering new industries and evolving its products to meet customer needs.

https://investors.fadel.com/

Tarek Fadel, Founder & CEO

Tarek founded FADEL in 2003, he is responsible for driving its long-term strategic plan as well as overseeing the day-to-day management of the Group. He has more than 27 years of experience building, selling and implementing enterprise software applications. He served at Cambridge Technology Group between 1995 and 1997, before spending 6 years with Oracle Corporation, a cloud technology company, where he managed a consulting practice for Oracle responsible for the success of several large ERP and E-Commerce client implementations, and held the position of Director of Product Management releasing several Oracle CRM products. Tarek graduated from the Lebanese American University in Computer Science, has a Bachelor of Science in Computer and Information Science from The City University of New York and an Executive MBA from Columbia Business School and holds a technology patent for his work on Method and Apparatus for e-Commerce Integration Architecture and Process.

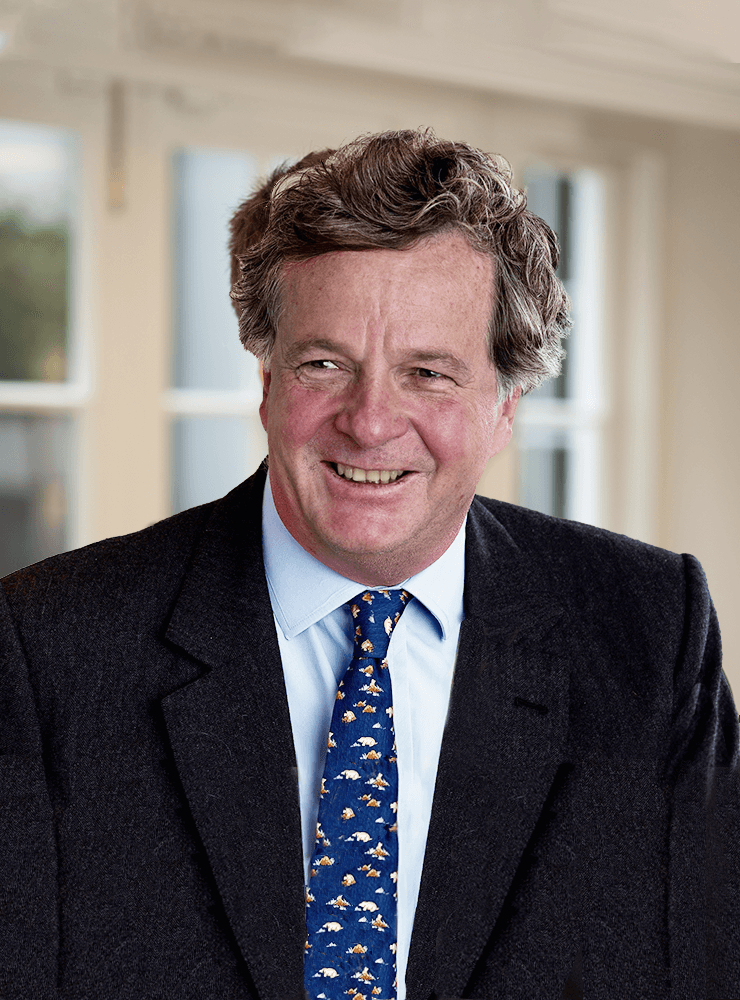

Vicary Gibbs, CFO

Vicary was previously an Investment Banker with over 20 years’ experience in advising companies on M&A, capital raising and restructuring transactions working for a variety of investment banks including Bank of Montreal, Hawkpoint Partners, Bank of America, Deutsche Bank and Robert Fleming & Co. He is an experienced UK plc director, having served as the Chief Financial Officer at Jersey Oil and Gas plc, which he joined in 2018. He is responsible for managing the finance function at FADEL as well as business planning, strategy and M&A, including raising capital for M&A and organic growth opportunities.

Company Presentation – NASCIT plc

NASCIT is a special situations investment trust dedicated to a long-term capital appreciation objective, to achieve positive absolute returns for shareholders with low correlation to the overall market.’

North Atlantic Smaller Companies Investment Trust PLC (‘NASCIT’) targets capital appreciation for its shareholders through investing primarily in smaller cap public and unquoted companies. NASCIT has been run by Christopher Mills since 1982, using a bottom-up approach when determining investment strategy. The Company uses a multifactor philosophy; to identify companies that have low levels of debt, quality management, and a competitive advantage – taking a private equity approach to ‘special situations’ with a unique sourcing strategy.

NASCIT’s investment team has nearly 50 years of combined experience in listed and private equity small cap investing and is made up of a broad network of deep sector specialists. The team’s active engagement and conviction positions augment value realisation, underpinning NASCIT’s strong performance since inception. Rigorous analysis of investments, spread geographically and by industry type, asset class, and indirect holdings, have been a mainstay in reducing volatility.

The Company maintains strategic cash balances for the agile purchasing of blocks of stock, to maximise opportunities resulting from access to preferential deal sourcing, combined with a broad network of deep sector specialists and operational ‘change makers’ with ‘skin in the game’.

Christopher Mills, Chief Executive Officer and Investment Manager

Christopher has been Chief Executive Officer and principal shareholder of Harwood Capital Management since 2011. He founded JO Hambro Capital Management with Jamie Hambro in 1993 acting as Chief Investment Officer and Harwood Wealth with Alan Durant in 2013 until their respective sales in 2011 and 2020. He is CEO of North Atlantic Smaller Companies Investment Trust (“NASCIT”) which he has managed since 1982 and Executive Director of Oryx International Growth Fund which he has managed since 1995.

NASCIT has delivered a total NAV per share of nearly 200x under Mr Mills’ management and is the winner of numerous Micropal Sunday Telegraph and S&P investment trust awards. He has sat on the Board of over 100 companies during his career including most recently Augean, MJ Gleeson, SureServe, Frenkel Topping and is currently Chairman of EKF Diagnostics and Renalytix AI. He was awarded a scholarship to go to university by Samuel Montagu and has a BA in Business Studies.

Company Presentation – Windward (LON: WNWD)

Windward is a leading predictive intelligence company, fusing artificial intelligence and maritime expertise seeking to digitalise the global maritime industry.

Windward’s AI-powered software solution provides real-time information and insights on the maritime sector, enabling intelligence-driven decisions to manage risk and achieve business and operational efficiencies. Founded in Israel in 2010 by Ami Daniel and Matan Peled, and Chaired by ex-BP CEO, Lord Browne, Windward was born out of their recognition of the critical issue of data visibility in the maritime sector. As the only end-to-end AI-driven solution in the market, Windward leads the way in digitalizing the massive and growing maritime opportunity.

Windward’s diverse customer base includes prominent participants across the maritime industry such as banks, commodity traders, insurers, government agencies, and major energy and shipping companies. Notable customers include BP, Shell, HSBC, Gard, Danske Bank, and leading government agencies such as those within the US Department of Defense and Homeland Security, Frontex (the pan-European border and coast guard agency), and the United Nations.

With over 150 customers worldwide, Windward has only started to scratch the surface of a significant market opportunity, which spans over 6 million organizations with an estimated total addressable market of over $10 billion.

With a cloud-based, subscription model, Windward benefits from high gross margins and a scalable business model. Windward’s 2022 revenue was $21.4m (+25%) and the annual contract value of $25.5 million (+21%), with 99 per cent of the revenue being subscription based.

In the Company’s AGM Statement, released in May, the Board confirmed demand for Windward’s AI powered predictive intelligence platform has continued into 2023, delivering top line growth which alongside the careful management of costs is expected will reduce the time taken to reach profitability. The Company confirmed it had already seen in Q1 the effect of the cost control measures instigated in late 2022.

Ami Daniel, Co-founder & CEO

Ami Daniel, Co-founder & CEO

Ami is co-founder and CEO of Windward and has been a Board member since incorporation. Under his leadership Windward has been awarded multiple awards, including as a finalist in the Boldness in Business Awards by the FT, Red Herring, The Hottest Startup in Israel by Wired and many others. Ami has been recognised as one of the 40 most promising entrepreneurs in Israel twice by Israel’s leading economical newspapers – Globes and The Marker. He has been featured extensively as an expert in shipping and AI at multiple conferences, events, op-eds and interviews, including by The Economist, The FT, WSJ, Bloomberg and many others. Before founding Windward, Ami was one of Israel’s most impactful youth social entrepreneurs, given multiple awards including the President’s Award and the Ramon Award (both the most distinguished for youth in Israel). Ami served as a naval officer (Lieutenant) in the Israeli Navy, and he holds an LLB from Tel Aviv University

Ofer Segev, CFO

Ofer joined the Company as Chief Financial Officer in October 2019 and he joined the Board in December 2021. With over 25 years of management experience in the high-tech and services sectors in small and large international companies, Ofer was a partner at Ernst & Young in Israel, where he led the high tech sector team, and he served as Chief Financial Officer of private and public companies including Ness Technologies Inc, where he also served as the CEO. Ofer is an independent director and serves as a member of the Audit Committee of Varonis Systems, Inc. (Nasdaq listed company) and sits on the Board of Directors of Verix, Inc.

Company Presentation – REACT (LON: REAT)

REACT Group plc, a leader in the specialist cleaning, decontamination, and hygiene sector, is listed on the AIM market of the London Stock Exchange.

The business operates from three main divisions:

React and Fidelis – the core business includes regular deep cleaning regimes in the health and education sectors, on parts of the rail network and the highways; emergency call-out work to respond to trauma, anti-social behaviour, and other hazardous incidents across a range of sectors including working for some of the industry’s largest facilities management (“FM”) firms. React and Fidelis benefit from a blend of contract maintenance work, contract reactive work and ad hoc work.

LaddersFree, one of the largest commercial window cleaning businesses in the UK, compliments the Company’s value proposition perfectly, adding strength to the Group’s capability to deliver high quality services across the UK where much of its competition is relying on sub-contractors.

The Company has a strong balance sheet and more than 80% of revenue is contracted and recurring. It has great customer relationships and growing demand for national coverage positions REACT well to materially improve shareholder value through continued organic growth and selected M&A.

Shaun Doak, Chief Executive Officer

Appointed February 2020 having joined the group in March 2019 as Managing Director of REACT Specialist Cleaning with a proven track record of growing businesses in the specialist cleaning, facilities management and HVAC services sectors.

Mark Braund, Chairman

Appointed December 2020 having worked with the Group as its strategic & operational advisor throughout the turnaround period. Mark has a strong track record of leading teams through sustainable and profitable change and materially improving shareholder value. Mark has significant experience across a number of business sectors, both UK and overseas. He has been the CEO of two AIM listed businesses, the most recent being RedstoneConnect Plc., leading the team through a well-documented turnaround, the profitable sale of legacy assets and the development/carve-out of an exciting software technology business, now known as Smartspace Software Plc.

The Mello BASH (Buy, Avoid, Sell & Hold)

Damian Cannon Private Investor

Paul Scott Private Investor and Analyst for Stockopedia

MelloMonday Sponsors

Hardman & Co is a multi-disciplinary financial consultancy and investment research firm, employing highly experienced analysts and professionals with a broad range of capital markets expertise.

Click here for Hardman & Co research.

Progressive introduces you to new investment ideas. FCA authorised and regulated, we provide freely available equity research and connect investors with companies across every sector of the market.

Progressive introduces you to new investment ideas. FCA authorised and regulated, we provide freely available equity research and connect investors with companies across every sector of the market.

Click here to receive our research and be invited to our regular investor events.