Wednesday 22nd May – Thursday 23rd May 2024, 9am – 6pm

Keynote Speakers and Panelists

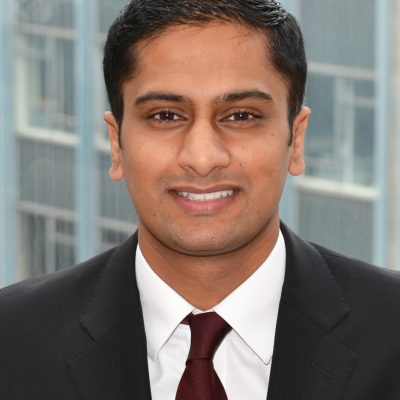

Katen Patel, executive director, is a portfolio manager within the J.P. Morgan Asset Management International Equity Group, based in London. An employee since April 2013, he previously worked at HSBC Bank Plc in a European equity sales role. He obtained a BSc. in Management from the London School of Economics and Political Science. Katen is a CFA charterholder.

Thursday

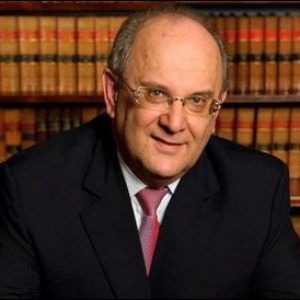

Founder, Director, Chief Executive Officer and Chief Investment Officer

Chief Executive Officer and principal shareholder of Harwood Capital Management since 2011. He founded JO Hambro Capital Management with Jamie Hambro in 1993 acting as Chief Investment Officer and Harwood Wealth with Alan Durant in 2013 until their respective sales in 2011 and 2020. He is CEO of North Atlantic Smaller Companies Investment Trust (“NASCIT”) which he has managed since 1982 and Executive Director of Oryx International Growth Fund which he has managed since 1995. NASCIT has delivered a total NAV per share of nearly 200x under Mr Mills’ management and is the winner of numerous Micropal Sunday Telegraph and S&P investment trust awards. He has sat on the Board of over 100 companies during his career including most recently Augean, MJ Gleeson, SureServe, Frenkel Topping and is currently Chairman of EKF Diagnostics and Renalytix AI. He was awarded a scholarship to go to university by Samuel Montagu and has a BA in Business Studies.

Wednesday

Head of Equities at Premier Miton Investors

Fund Manager: The Diverse Income Trust plc, Miton UK MicroCap Trust plc, Premier Miton UK Multi Cap Income Fund, Premier Miton UK Smaller Companies Fund

Gervais Williams is Head of Equities at Premier Miton Investors and manages a number of funds and trusts that aggregate to over £1.5bn, he joined the group in 2011. His fund management career extends over 30 years including 17 years at Gartmore Group Ltd, where he was Head of UK Small Companies investing in UK smaller companies and Irish equities. Gervais is a member of the AIM Advisory Council, and President of the Quoted Companies Alliance. He was a member of the Patient Capital Review panel with the Chancellor of the Exchequer six years ago where the recommendations were put into legislation in the subsequent budget. Gervais Williams has published three books, ‘Slow Finance’ in the autumn of 2011 (Bloomsbury), ‘The Future is Small’ published in November 2014 (Harriman House) and ‘The Retreat of Globalisation’ published in December 2016 (Harriman House).

Thursday

John Lee is regarded as one of the UK’s leading private investors having bought his first shares sixty years ago. He was one of the earliest to recognise the long-term potential of PEPs, the forerunner of ISAs when they were launched in 1987 and was judged to be the first ISA “millionaire” in 2003. He has written over 250 articles for FT Money and has given numerous lectures and interviews on his investment philosophy as a long-term “value” investor. In 2014 Pearsons published his well-received How to Make a Million – Slowly: my guiding principles from a lifetime of successful investing. He is a Chartered Accountant with a wide experience of investment banking and business and is Patron of ShareSoc, the leading body lobbying and campaigning on behalf of private investors. From 1979-92 he was a Member of Parliament, during this period he was both a Defence and Tourism Minister. A former High Sheriff of Greater Manchester, he sits as a member of the House of Lords as Lord Lee of Trafford and lives in Richmond, Surrey. In 2019 he published Yummi Yoghurt: A First Taste of Stock Market Investment! which is aimed at teenager/novice investors. http://bit.ly/YummiYoghurt. He also now streams a monthly podcast with The Investors Chronicle called “Lee and the IC”.

Wednesday

Paul is a professional investor, capital markets commentator & equity analyst with more than 30 years experience

Thursday

I am a Full Time Professional Investor, having enjoyed a 30 year career working the Retail Industry, and been a Director of many well know High Street names. I have been fortunate to work directly for some of the greatest Retailers of the last generation, including Lord Kirkham, Sir Philip Green (interesting experience!!) and Sir Stuart Rose. Fortunate to have learned from some of the very best. I post occasionally on message boards as “Simso”…going right back to PaulyPiliots Pub and the old Motley Fool days! Current investment strategy is specifically focussed on stocks which benefit from the current environment.”

Wednesday

Mark Simpson has been investing in individual stocks since 2003. Over the last decade Mark has generated a 19% compound annual return following a Value methodology vs a FTSE All-Share Total Return Index that has returned less than 8% over the same period. He has achieved this out-performance by developing a strategy that plays to his unique strengths and overcomes his weaknesses, in particular finding practical ways to overcome behavioural biases. His book Excellent Investing describes this approach and how investors of all types can generate higher and more consistent returns by developing their own strategy that plays to their strengths and overcomes their weaknesses.

Both days

Edward Page Croft, CFA, is the CEO & founder of Stockopedia.com – the award-winning stock selection & portfolio analysis platform for individual investors. Ed has a background in asset management, having managed ultra high net wealth private client accounts at Goldman Sachs and a family office. Ed is a committed educator and regular keynote speaker at investment conferences focusing on the benefits of systematic investing in countering common behavioural biases.

Thursday

Charles Bond is a partner at the international law firm Gowling WLG, where he acts as UK head of Public Companies and Capital Markets and the firm’s Natural Resources sector. Charles advises on equity capital markets and public and private M&A for clients in a variety of sectors. He often advises the boards of public companies, and is himself Chair of a Main Market listed company, Great Southern Copper Plc

Thursday

Frank Lewis has immense experience as a serving non-executive director and Chairman of both quoted and private companies.

On more than one appointment, Frank has joined an established company that required quoted plc experience at board level before coming to the market. Frank is actively involved in mentoring CEOs and SME Boards and working with entrepreneurs to grow their businesses.

Frank is a past serving member of the London Stock Exchange’s AIM Advisory Group, a group of market professionals that provide input to the London Stock Exchange regarding the operation and regulation of AIM.

Thursday

Leon is a retired Chartered Accountant and Corporate Financier. He has been investing since he was a teenager and has generated significant capital growth in his ISAs and SIPPs. Despite a single digit percentage loss in 2021 and making only modest gains in 2022 he has generated annualised returns in his ISA in excess of 17% p.a. over the last 30 years. He has a variety of interests which have helped occupy his time during the bear markets of recent years.

Both days

David O’Hara is Founder of Blackthorn Focus, publisher of AIM Prospector, the online publication dedicated to AIM-quoted companies. David is an enthusiastic investor in shares and author of a successful government epetition that called for an end to the ban on AIM shares in ISAs.

Thursday

Exhibiting and Presenting Companies

Burford Capital is the leading global finance and asset management firm focused on law. Its businesses include litigation finance and risk management, asset recovery and a wide range of legal finance and advisory activities. Burford is publicly traded on the New York Stock Exchange (NYSE: BUR) and the London Stock Exchange (LSE: BUR), and it works with companies and law firms around the world from its offices in New York, London, Chicago, Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

Wednesday, Exhibit only

Rockwood Strategic Plc is an Investment Trust that invests in a focused portfolio of smaller UK public companies. The strategy identifies undervalued shares, where the potential exists to improve returns and where the company is benefitting, or will benefit, from operational, strategic or management changes. These unlock, create or realise shareholder value for investors.

Thursday, Present only

Warpaint has been listed on AIM since 2016, and is a profitable, cash generative, dividend-paying business with no debt. Warpaint sells branded cosmetics under the lead brand names of W7 and Technic. W7 is sold in the UK primarily to major retailers and internationally to local distributors or retail chains. The Technic brand is sold in the UK and continental Europe with a significant focus on the gifting market, principally for high street retailers and supermarkets. In addition, Warpaint supplies own brand white label cosmetics produced for several major high street retailers. The Group also sells cosmetics

using its other brand names of Man’stuff, Body Collection, Very Vegan, and Chit Chat, each targeting a different demographic.

Wednesday, Present & Exhibit & Thursday, Present only

Polar Capital is a specialist active fund management company offering investors a diverse range of funds that are actively managed and led by experienced teams across regional, thematic and sector markets to deliver the best outcome for our clients.

Polar Capital manages a range of predominantly long-only equity funds, including three award-winning thematic investment trusts in the specialist sectors of technology, healthcare and financials. They have a fundamental, research-driven approach, where capacity is rigorously managed to enhance and protect performance.

Wednesday, Exhibit & Present

The Property Franchise Group PLC (AIM: TPFG) is the UK’s largest multi-brand property franchisor, with a network of over 910 lettings and estate agency businesses delivering high quality services to residential clients, combined with an established Financial Services business.

The Company was founded in 1986 and has since strategically grown to a diverse portfolio of 15 brands operating throughout the UK, comprising longstanding high-street focused brands and two hybrid brands. The Property Franchise Group also

includes one of the UK’s leading networks for mortgage intermediaries, Mortgage Advice Bureau.

The Property Franchise Group’s brands are Belvoir, CJ Hole, Country Properties, Ellis & Co, EweMove, Hunters, Lovelle, Martin & Co, Mr and Mrs Clarke, Mullucks, Newton Fallowell, Nicholas Humphreys, Northwood, Parkers, and Whitegates

Wednesday, Exhibit & Present

Premier Miton

Thursday, Present only (Keynote)

JPMorgan Asset Management

Thursday, Present only (Keynote)

Time Finance plc is an AIM-listed business whose purpose is to help UK business thrive and survive through the provision of flexible funding solutions. UK Businesses can take advantage of its multi-product finance range comprising of Asset Finance, Invoice Finance, Secured Loans and Asset Based Lending. Since a new strategy was implemented in 2021, the business has grown rapidly, focussing on being an ‘own-book’ lender. Time Finance works with its introducer community to provide (as of Nov 2023) £188 million of funding to over 10,000 UK businesses to support their growth. Time Finance operates from four locations across the UK – Bath, Reading, Manchester, and Warrington and has over 140 employees.

Thursday, Present only

Anexo is a specialist integrated credit hire and legal services provider. The Group has created a unique business model by combining a direct capture Credit Hire business with a wholly owned Legal Services firm. The integrated business targets the impecunious not at fault motorist, referring to those who do not have the financial means or access to a replacement vehicle.

Through its dedicated Credit Hire sales team and network of 1,100 plus active introducers around the UK, Anexo provides customers with an end-to-end service including the provision of Credit Hire vehicles, assistance with repair and recovery, and claims management services. The Group’s Legal Services division, Bond Turner, provides the legal support to maximise the recovery of costs through settlement or court action as well as the processing of any associated personal injury claim.

Bond Turner also operates a specialist housing disrepair division, dealing with claims around substandard conditions in rented properties, and is involved in large loss litigation and class actions including diesel emissions claims.

The Group was admitted to trading on AIM in June 2018 with the ticker ANX. For additional information please visit: www.anexo-group.com

Wednesday, Exhibit & Present

Poolbeg Pharma plc is committed to the development and commercialisation of innovative medicines targeting diseases with a high unmet medical need. Its model focusses upon developing its exciting clinical assets and commercialising approved and marketed drugs to fund

the development of its robust pipeline of innovative products, thereby driving significant value creation.

Poolbeg is led by an experienced leadership team with a history of delivering significant shareholder value. The team has been strengthened by the appointment of three former members of the Amryt Pharma plc leadership team, with the intention of repeating Amryt’s success and generating near term revenues.

Poolbeg’s clinical programmes target large addressable markets including CRS induced by cancer immunotherapies, infectious disease, and metabolic conditions such as obesity with the development of an oral GLP-1R agonist. It uses a cost-effective development philosophy to generate high quality human data to support partnering and further development. Its AI-led infectious disease programmes analyse unique data from human challenge trials to identify clinically relevant drug targets and treatments, leading to faster development and greater commercial appeal.

Wednesday, Present only

Invesco Perpetual UK Smaller Companies Investment Trust plc focuses exclusively on small to medium-sized companies. Our two specialist fund managers have lived and breathed UK small business for almost half a century between them, developing a tried-and-tested, repeatable process to find fast-growing small business opportunities that many would overlook.

There are almost 2,000 quoted smaller companies in Britain. In the next decade, some may triple, quadruple, even quintuple in size. Not everyone recognises the opportunity, and still fewer know how to find the most exciting prospects. Because where others see small, we see extraordinary.

About Invesco

Invesco Ltd. is a global independent investment management firm dedicated to delivering an investment experience that helps people get more out of life. In the UK we manage £1bn in investment trust assets on behalf of our investors (as at 31 March 2024).

Investment risks

Capital at risk. The investment trust invests in smaller companies which may result in a higher level of risk than a product that invests in larger companies. The investment trust uses derivatives for efficient portfolio management which may result in increased volatility in the NAV.

Important information

The Key Information Document (KID) is available on our website. Issued by Invesco Fund Managers Limited.

Thursday, Exhibit & Present

SulNOx Group Plc (Ticker: SNOX) – Taking You Further, Faster and Cleaner

The Greentech company providing next generation, natural solutions, for immediate progression towards carbon neutrality.

The world’s reliance on hydrocarbon liquid fuels continues to grow despite the success in many forms of renewable energy. SulNOx Group Plc specialises in inventing immediate and responsible solutions towards decarbonisation. Our patented, Greentech fuel conditioners are unique in reducing fuel consumption and the production of harmful, environmentally damaging greenhouse gas emissions such as NOx (>30%), whilst also reducing deadly Particulate Matter (PMs), including soot and smoke (PM2.5 ↓60+% and PM10 ↓50+%).

Simple to use and immediately effective, SulNOx has successfully sold our high margin, subscription products in 34 countries and are now demonstrating improving revenues with back-to-back record trading quarters, driven by expanding sales in Africa and the marine sector. Unaudited full year 2024 revenues were £555,290, almost triple the previous year (£203,061) with unaudited Q4 revenues of £314,995, up 201% on Q3 (£104,572) and up 282% vs Q4 2023 (£82,546).

How it Works: SulNOxEco™ Fuel Conditioners enhance all gasoline/petrol, diesel, marine fuels and biofuels by improving the burn profile. Given the amount of fuel consumption and emissions depends on the quality of combustion, SulNOx’s unique emulsification technologies promote cleaner combustion to optimize energy output, meaning reduced fuel consumption (typically between 8% and 10%). SulNOx also adds natural lubricity (now lacking with the removal of sulphur in fuel) and provides detergency to clean engines – leading to further savings, such as AdBlue reductions) and other mechanical benefits.

What sets SulNOx apart: Traditional fuel additives are often fossil fuel-based formulations from waste refinery products and solvents such as naphthalene or xylene. They work like adding lighter fluid to a fire to make the combustion burn harder and brighter. This is neither a solution for decarbonisation nor does it help reduce the harmful impact that fossil fuel combustion is having on air quality and the environment.

SulNOx has partnered with EcoVadis Platinum rated Nouryon BV (formerly Akzo Nobel) to produce our Greentech products given their global scale and reputation.

SulNOx is able to improve 70% of every barrel of oil and all internal combustion engines across diverse sectors with global applicability. Industries which benefit include fuel storage and distribution (petrol stations), transport (haulage, rail, buses/coaches, taxis etc.), marine, mining & construction and waste oil reclamation.

SulNOx is a UK Public Limited Company, formed in 2012, trading on the pan-European Apex segment of the AQSE (Aquis Stock Exchange) growth market with ticker SNOX.

For more information, please contact SulNOx through the website at https://sulnoxgroup.com or email info@sulnoxgroup.com.

Wednesday, & Thursday Present & Exhibit

ShareSoc is a not-for-profit membership organisation, created by investors for investors. Our aim is to help you become better investors in the stock market and ensure you are treated fairly. We do this by:

• Providing direct access to Directors of growth companies

• Enabling you to network with our community of like-minded people

• Providing education and information

• Lobbying for your shareholder rights with Government and Regulators

• Campaigning against companies that treat you badly

We already have thousands of members – so come and join us – its time you stopped missing out.

WEBSITE – https://www.sharesoc.org/

Twitter : @ShareSocUK

Facebook : @ShareSoc

Linkedin : ShareSoc

Exhibit & Present

Eleco plc (AIM:ELCO)

Eleco plc is an AIM-listed, specialist international provider of software and related services to the built environment, with operations in the UK, Sweden, Germany, the Netherlands, Romania and the USA.

Eleco’s best-of-breed solutions are trusted by international customers and used throughout the building lifecycle from early planning and design stages to construction, interior fit out, asset management and facilities management.

The Group’s strategy is to build on its established and leading position in the built environment through a combination of organic and inorganic growth. Executing on the strategy involves meeting the increasing challenges of companies in the construction and built environment sectors who are moving towards digitalisation and more efficient and sustainable building methodologies. Eleco’s software is proving crucial in improving decision-making, driving productivity and better planning of resources. Operating in such an attractive market gives the Group an excellent opportunity to leverage its market position, strengthen its platform and drive organic growth.

Eleco’s vision is to create certainty for the built environment by being the trusted technology partner to all stakeholders, which is especially important in sustaining its growth ambitions in the current economic climate.

Wednesday, Exhibit only

GIBUS is the Italian brand protagonist of the high-end Outdoor Design sector for HO.RE.CA. and Residential, present in Italy and the main European countries with a network of +400 GIBUS Ateliers which is unique in the national and international competitive landscape. With headquarters in Saccolongo (PD), it designs 100% Made in Italy products and oversees the entire value chain. GIBUS has a consolidated market share in Italy and has strengthened its presence abroad, particularly in France and the DACH area. It constantly invests in R&D and, with over 50 patented technical solutions and 30 protected design models, has defined new quality standards in the sector: raising the technological content and product design is the key to compete in the high-end segment of the outdoor sector and to meet the needs of increasingly greater comfort in the use of outdoor spaces. The main product lines, Luxury High Tech (Bioclimatic Pergolas) and Sustainability (ZIP Screen), are characterized by their level of design and technology and represent the main growth driver of the Company. Historically the products make the combination of mechanical technology and textile processing know-how their strongpoint, and electronics have become increasingly important in recent years: today the company is able to offer fully automated solutions, capable of responding automatically to changes in weather conditions, and connected to web platforms for remote control.

Wednesday, Exhibit & Present

Velocity Composites plc is the leading supplier of advanced composite material kits to aerospace and other high-performance manufacturers. Velocity manufactures the kits for use in the production of carbon fibre composite parts for aerospace and other high-performance manufacturers, such as automotive OEMs, and pioneers of renewable energy applications. The kits reduce costs and improve sustainability. This technology is in increasing demand as the aerospace manufacturing sector recovers from the pandemic. Based in Burnley, Lancashire, Velocity Composites is a market- leading business, benefiting from the growing need to improve the sustainability of aviation. There has been a step-change in the use of carbon fibre in aircraft as manufacturers have to decrease aircraft weight and improve their efficiency to reduce emissions.

By using Velocity’s kits, produced using their proprietary technology, manufacturers can reduce waste and free up internal resources to focus on their core business. Velocity has a critical position in the aerospace supply chain, forming a bridge between major raw material manufacturers and blue-chip aerospace manufacturers, such as Boeing, Airbus and global partners such as GKN with whom it has long-standing relationships. Velocity’s proven, innovative technology means reduced raw material waste, improved safety through better traceability and improved efficiency by digital management of the whole process.

Velocity has significant potential for expansion in the coming years, especially in the US, having recently opened a facility in Alabama. This follows the signing of a five-year Work Package Agreement with the Company’s US launch customer, a Tier 1 aerospace manufacturer. The Contract is worth $20m per annum in revenue over at least the next five years starting from 1 January 2024, and represents Velocity’s first entry into the US, the largest aerospace manufacturing market in the world. The facility can be scaled to support multiple customers in the region. Velocity has live bids with large Tier 1 customers in both Europe and North America. Velocity Composites has put into effect a clear strategy to capitalise on the significant growth in the use of composites within aerospace. Manufacturers need to outsource non-core processes and reduce costs to meet demand, and are now approaching Velocity for solutions, leading to a current qualified pipeline of opportunities of £200m ($250m) annually.

Wednesday, Present & Exhibit

Team Internet (AIM: “TIG”) is a leading global internet solutions company headquartered in London. The company operates in two highly attractive markets: high-growth digital advertising (Online Marketing segment) and domain name management solutions (Online Presence segment). Team Internet has been recognized as one of the top-50 tech industry companies in the FT 1000 list and has also been included in the FTSE AIM UK 50 and AIM 100 indices.

The Online Marketing segment is dedicated to helping online consumers make informed choices through the provision of privacy-safe, easy-to-understand advertorials and review websites. The company uses artificial intelligence-based customer journeys to convert general internet users into high-confidence consumers. Team Internet captures the value it creates for consumers through strategic partnerships with world-leading search and e-commerce partners, generating utility style revenues.”

The Online Presence segment serves as a distribution channel for digital products, particularly domain names, and stands out by providing the broadest inventory of domain extensions through fully automated APIs and fulfilment services. The company offers web hosting companies, leading international brands, and SMBs one-stop-shop access to all their needs. Additionally, operators of country-code and generic domains benefit from access to an unrivalled distribution network. Team Internet generates highly reliable subscription based revenues from its services.

Wednesday, Present & Exhibit

Good Energy is a supplier of 100% renewable power and an innovator in energy services. It has long term power purchase agreements with a community of over 2,000 independent UK generators.

Since it was founded 20 years ago, the Company has been at the forefront of the charge towards a cleaner, distributed energy system. Its mission is to power a cleaner, greener world and make it simple to generate, share, store, use and travel by clean power. Its ambition is to support one million homes and businesses to cut carbon from their energy and transport used by 2025.

Good Energy is recognised as a leader in this market, through green kite accreditation with the London Stock Exchange, Which? Eco Provider status and Gold Standard Uswitch Green Tariff Accreditation for all tariffs.

Thursday, Present only

Since its inception in 1981, Zinc Media Group has established itself as the UK’s leading television and content creation powerhouse, renowned for its award-winning and critically acclaimed factual TV and multimedia content. The UK’s only TV content creation company listed on the London Stock Exchange, they have a strong foundation in producing impactful storytelling, earning the trust of TV broadcasters, platforms, brands, advertisers, and businesses around the globe.

Operating from its offices in London, Manchester, Macclesfield, Glasgow, Aberdeen, Belfast, Bristol, and even extending its reach to Qatar, Zinc Media Group has consistently expanded its portfolio. Renowned for producing compelling programmes such as ‘Putin vs The West’, ‘Inside Obama’s White House’, and ‘Afghanistan: Getting Out’, the group has also excelled in a variety of genres, including long-standing hits like ‘Bargain Loving Brits’ and ‘Sunday Morning Live’. Beyond television, Zinc Media has ventured into corporate films, podcasts, audio experiences, branded entertainment, and publishing, demonstrating a versatile and innovative approach to content creation.

Zinc Media Group’s array of television production labels showcases its diverse capabilities: Atomic specialises in premium specialist factual content; Brook Lapping is known for its exceptional current affairs, contemporary history, and investigative reporting; Rex focuses on popular factual documentaries; Red Sauce brings factual entertainment to life; Supercollider champions genre-blending content for TV and brands; and Tern TV enhances the group’s reputation with its multi-award-winning factual productions across the Nations.

The Group’s Commercial Content Creation division further exemplifies its breadth, featuring Zinc Communicate, which excels in creating advertiser-funded programming, digital entertainment, and corporate films, among other services. The Edge Picture Company, one of the largest brand filmmaking production companies in the UK and the Middle East, adds to the group’s accolades with over 700 awards, serving a global client base that includes some of the world’s leading brands and charities.

Zinc Media Group’s enduring success and innovation in content creation across multiple platforms affirm its status as a leader in the industry, shaping narratives and engaging audiences worldwide.

Thursday, Exhibit & Present

Italian Wine Brands ( IWB) is a leading producer and distributor in the Italian wine industry. IWB is amongst the largest domestic privately-owned wine groups thanks to massive organic growth coupled with several strategic acquisitions since its establishment. The group produces high quality wines in Italy’s most prestigious winemaking regions, including Veneto (in particular, the Prosecco area), Tuscany and Piedmont where super-premium wines are produced, as well as Apulia. The group operates through three distribution channels, namely Wholesale, Distance Selling and Ho.Re.Ca., thus covering both the off- and on-trade (B2B) as well as the online (B2C) segments. In detail, IWB distributes both branded products and privately labelled (over 70 owned brands) in more than 90 countries in 5 continents.

Business model is “asset light” so the group does not own any vineyards; raw materials (grapes, must and bulk wine) are procured from Italian wine producers and then processed in the group’s proprietary wineries. IWB takes care of the key points of the value chain, namely winemaking, ageing, bottling, distribution, and marketing, thus keeping its business model extremely flexible and adaptable to market trends and customer behaviours and taste.

In 2023 the group performed its best, till now, results:

– Adjusted EBITDA exceeded the threshold of Euro 44 million for the first time in IWB’s history, with 19% growth compared to the previous year.

– The banking net financial position improved from Euro 122M to Euro 96M, while that including IFRS 16 and deferred prices improved from Euro 147M to Euro 115M, with an adjusted NFP/EBITDA index of 2.6x. This NFP, the result of a season of very intense acquisitions, which led the group to double in size in just 3 years, is mostly financed with a bond loan of Euro 130 million, at a fixed rate 2.5% expiring in May 2027.

All this with an unchanged turnover compared to the previous year. In 2023 IWB realized the new group’s corporate structure, live from January 1, 2024, with a reduction to just two Italian operating companies (in addition to the holding company):

(i) IWB Italia SpA, within which all the production sites have merged and where we concentrated marketing to “wholesale” customers and,

(ii) Giordano Vini SpA, dedicated to “direct to consumer” sales, with the Giordano and Svinando brands,

to be ready for new organic an M&A development.

Wednesday, Exhibit & Present

European Green Transition plc (listed on the AIM London Stock Exchange under the ticker “EGT”) is a business operating in the green economy transition space in Europe. EGT intends to capitalise on the significant opportunity created by Europe’s transition away from fossil fuels to a green, renewables-focused economy. The Company plans to expand its existing portfolio of green economy assets through M&A, targeting distressed and undervalued projects. EGT sees substantial opportunities to deliver value from its M&A pipeline, which includes critical material, wind, solar, processing and recycling projects. EGT’s highly experienced leadership team have a strong track record of building successful public companies through the acquisition of distressed assets. EGT plans to replicate this approach, creating a sustainable and profitable business while generating significant shareholder returns.

The Company’s current portfolio of green economy assets includes the Olserum Rare Earth project in Sweden. The Olserum project is one of Sweden’s projects of “National Interest” and has the potential to become Europe’s first operating rare earths mine. EGT own additional projects in northern Sweden and Germany which have defined and tangible upside with potential to realise near-term value inflection points in a cost effective manner. EGT’s objective is to build a profitable business while monetising some of its assets through sale or partnership with larger industry players or European end users. The team is focused on success while remaining committed to its defined ESG strategy, ensuring excellent development practices across all projects in addition to regular local community engagement.

Wednesday, Present & Exhibit

u-abode, led by founders Tim Hopson and Andy Mitchell, is poised to reshape the landscape of home buying and selling in the UK and beyond, throughout homeownership. With Tim’s IT expertise, including pioneering the NHS vaccine distribution programme and adapting it for COVID, and Andy’s background in risk management and governance training for financial institutions, u-abode merges technological prowess with blue-sky insight to create genuine disruption in the world of residential proptech.

At its core, u-abode offers the unique combination of a digital homeownership management tool and a peer-to-peer marketplace for homes. This innovative combination fundamentally changes the dynamics of the housing market by eliminating the need for traditional intermediaries, notably estate agents, and empowering homeowners to take control of their transactions.

One of u-abode’s standout features is its AI-powered instant listing generation. From content in their homeownership management tool, users can instantly and effortlessly create detailed listings for their homes, rich in factual and historical detail, and personalised to their preferences. This eliminates the reliance on agents and their costs – it’s free to use for both buyer and seller – and offers users a level of control and customisation previously unseen in the industry.

Beyond facilitating transactions, u-abode’s platform guides and accompanies users throughout their entire homeownership journey, as a home management tool for life. The innovative business model presents great potential for monetisation – selling to users products/services when browsing, buying, selling, moving in, moving out or simply owning/improving and maintaining. The model also fosters unparalleled levels of user retention – as the user’s ownership record becomes increasingly indispensable and valuable – and new user acquisition.

By harnessing the power of technology and removing intermediaries, u-abode is paving the way for a more accessible, transparent, and consumer-centric housing market. u-abode is set to shape the future of homeownership for generations to come.

Wednesday & Thursday, Exhibit & Present

Itaconix is a leading innovator in sustainable plant-based polymers used to decarbonise everyday products. We use a proprietary technology platform to produce and sell specialty ingredients and formulations that improve the safety, performance, and sustainability of over 160 products.

Our customers partner with us to define product claims that win in the marketplace, create formulations that enable the claims, and successfully deliver safer, high performing and cost-effective formulations and ingredients.

The company’s current ingredients are enabling and leading new generations of products for cleaning surfaces, fabrics, dishware, air, kitchens, bathrooms, and industrial applications.

Wednesday, Present

Different Kind is on a mission to do retail in a new way. The retailer, born in 2021, is passionate about changing business to be a force for good.

Everything Different Kind stock is created by producers who also have a social purpose – and that could be anything from creating jobs for young people with learning difficulties to increasing biodiversity. Every single supplier is trying to change the world in their own different way. That means customers don’t just buy a physical object, gifts from Different Kind also come with stories and knowledge.

Different Kind believe that doing good shouldn’t mean compromising on quality. These are brilliant products, curated with a focus on excellent design, delicious tastes and stylish practicality.

Different Kind stocks fantastic products, created by people with strong ethics that work for positive change. Well designed, well made, well intentioned.

Two years on Different Kind is a corporate gifting business, an online store and runs pop ups all over the country, from London to Devon, Oxford to Yorkshire, and for many big companies including Netflix and Bank BNP Paribas.

The launch of Different Kind

Different Kind co-founder and CEO, Liz Warner, was the CEO of Comic Relief when she had an idea.

Liz had asked the Comic Relief team to find gifts for Sir Lenny Henry’s 60th birthday and they, all had to be from suppliers with ethical and social impact. They found a set of beautiful glasses and a carafe, handblown in Eswatini by a company called Ngwenya. The amazing cake was made by London’s Luminary Bakery, an organisation who provide training for women who have experienced gender-based violence. The gifts were high quality, stylish and made a difference, but they had been hard to find.

Liz says “I could see the opportunity for a Conran Shop of purpose – a store where everything has an interesting story and everything does good.” “We’re fired up and motivated by finding gorgeous and useful items with social outcomes. You can be confident with every purchase you make from us that we really put in the effort to understand our producers aims and the change the want to see in the world, and how this translates into their product. We’ve done the homework.”

“We love our producers and what they do, every single product has a story to tell and is making a change in the world – so when you buy a gift from Different Kind, you are buying a bit of joy, as well as improving the world one purchase at a time. Shopping as activism!”

“Our mission is to challenge the norms of the retail industry, showcasing how it can be done differently, with kindness. We may be a small team, but we have big ambitions on how we can make an impact.”

Wednesday & Thursday, Exhibit & Present

Trident is a growth-focused diversified mining royalty and streaming company, designed to provide investors with exposure to the full spectrum of the mining industry, excluding coal. Its current portfolio provides investors with exposure to base, precious, bulk and battery metals and minerals, including lithium, gold, silver, copper, mineral sands, and iron ore. This diversified portfolio provides shareholders with exposure to the energy transition and the strong macro environment for a range of commodities whilst reducing individual commodity risk.

Trident is strategically focused on constructing a diverse portfolio spanning various geographic regions. This approach aims to mitigate political and geographical risks while prioritising resource-rich jurisdictions. Currently, over 60% of the net asset value of Trident’s portfolio is situated in the USA, Canada, and Australia, reflecting a deliberate emphasis on favourable mining jurisdictions. The Company has also adopted an investment mandate tailored for small-to-mid size transactions. Consequently, Trident is adept at acquiring high-value royalties that frequently escape the attention of larger industry counterparts.

Trident has a current portfolio of 21 royalty/offtake assets, of which 12 are currently cash flowing. For the year ended 31 December 2023, the Company reported a gross profit of US$4.16m (2022: US$2.99m) from reported net revenues of US$9.52m (2022: US$7.85m). Revenue is expected to build significantly over the coming years with current assets due to come into production, and through the acquisition of further royalties to expand the Company’s portfolio. Key revenue catalysts during 2024 include first production at the Greenstone, Dandoko and Sugar Zone Gold Projects, in addition to the La Preciosa Silver Project. The shift to producing assets will continue over the coming years with key operational developments including first production at the Thacker Pass Lithium Project, operated by Lithium Americas, which would pay to Trident $21m per year at a $25k lithium price, or ~$70m at 2022 highs.

As returns are enhanced through the growth of the portfolio and the advancement of many key assets, alongside the lowering cost of capital, Trident intends to deliver a dividend policy to shareholders when appropriate in the future.

Thursday, Present & Exhibit

In 2023, Cobra discovered a rare earth deposit with the potential to re-define the cost of rare earth production. The highly scalable Boland ionic rare earth discovery at Cobra’s Wudinna Project in South Australia’s Gawler Craton is Australia’s only rare earth project with the potential for in situ recovery (ISR) mining – a low cost, low disturbance method. Cobra is focused on de-risking the investment value of the discovery by proving ISR as the preferred mining method which would eliminate challenges associated with processing clays and provide Cobra with the opportunity to define a low-cost pathway to production.

Cobra’s Wudinna tenements also contain extensive orogenic gold mineralisation, including a 279,000 Oz gold JORC Mineral Resource Estimate, characterised by potentially open-pitable, high-grade gold intersections.

Wednesday, Present only

Light Science Technologies

Wednesday, Exhibit & Present

SIGnet is unique – a national network of individual investor groups across the UK.

A small coordinating core supports and enhances the benefits members can gain from the groups and from the network as a whole.

SIGnet gives individual investors the ability to meet their peers in groups. The format is designed to encourage free discussion and mutual education. Members are given the opportunity to improve their investment decision process.

SIGnet groups are not investment clubs; there is no central pot or collective investing. In SIGnet the individual investor is free to make their own decisions in their own time and in their own way.

Wednesday & Thursday, Exhibit only

Clipper Automotive electrify existing fleet vehicles. We are on a mission to decarbonise transport and drive towards a greener future. We believe the fastest, cheapest, most impactful way to decarbonise transport is to electrify existing fleet vehicles.

In the UK alone, there are 6 million polluting commercial vehicles that need to decarbonize within the next decade. Replacing them with new EVs would unleash a staggering 200 million tonnes of carbon emissions and cost £300 billion. We offer a smarter solution: upcycling existing vehicles to go all-electric and emission-free.

Our approach is not just environmentally sound; it’s also economically savvy. The benefits for Fleet Operators speak for themselves: 80% lower carbon emissions compared to the production of a new EV and at half the cost. With a conversion in under a week, it’s a true no-brainer. And the best part? We can perform this conversion for almost any vehicle. Clipper Automotive’s focus is on commercial fleet applications, where the impact is greatest, and the profits are substantial. Our story began with up-cycling London Black Cabs, converted from diesel to all-electric and now licensed in cities across the UK. We’ve harnessed cutting-edge integration technology to transform vehicles at scale; and are expanding the team, bringing in the skills and expertise we need to grow fast and make the most of this opportunity.

This is an emerging multi-billion-pound market. We are unlocking this and projecting £273 million in annual revenue, with £81 million in annual EBITDA within just 5 years, creating significant value for our shareholders. Now, we’re inviting you to join our journey. Our EIS Seed round is open, we’re seeking partners and investors who share our vision of making a substantial difference in the race to Net Zero while generating impressive returns

Wednesday, Exhibit only

Phoenix Copper Limited is an AIM listed company with a high potential polymetallic resource in Idaho, US. Our flagship project is the Empire Mine, which consists of an open pit presently identified to be holding a little under 130k tonnes of copper, 350k oz of gold, 10m oz of silver and 58k tonnes of zinc (measured and inferred) being brought into production in the near term. It will be a low-cost, highly cash generative project, anticipated to payback pre-production capital expenditure in under 2 years.

We’re aiming to fund development of the open pit via non dilutive debt, and use the significant free cash flow it will generate to expedite exploration of our other assets, with only around 1% of our 8,000 acre holding fully explored to date. Initial drilling results into the deep copper sulphides have revealed copper grades of up to 8.38%, with a possible tungsten/moly porphyry beneath, while at Navarre Creek early indications suggest the possibility of a Carlin style gold deposit. The area is truly polymetallic, with gold, silver, lead, zinc, copper, tungsten and molybdenum all present, making Phoenix ideally positioned to support the transition to a clean economy.

Phoenix is committed to the highest standards of ESG, which have been embedded at every stage of our mine design. We are working closely with the community and are using environmentally friendly processes to extract metals. Our electricity is from 70% renewable sources and our focus is on producing clean energy metals to the highest ESG standards.