7th June 2021, 6.00pm – 9.30pm

Programme for the evening

6.00 pm Mello welcome and News

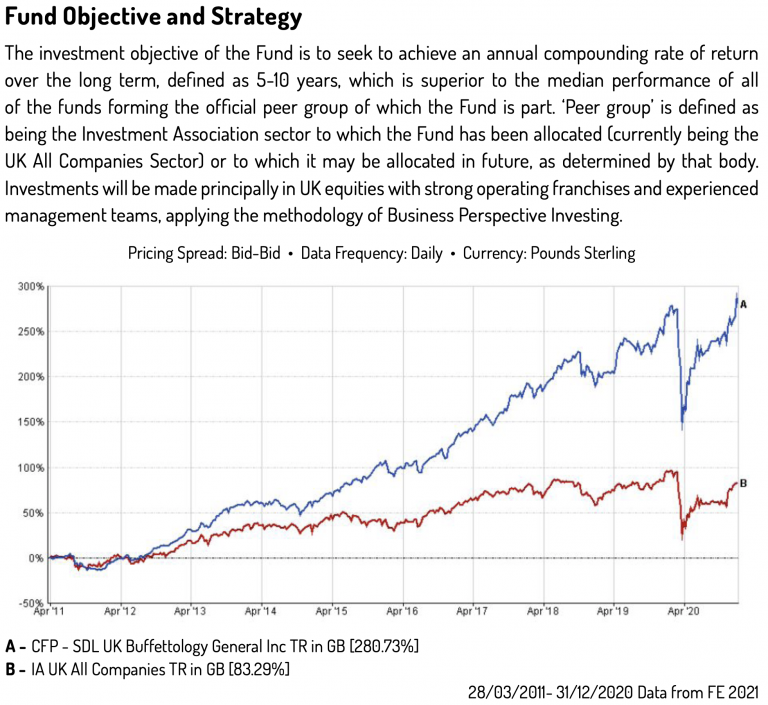

6.05 pm Interview with Keith Ashworth-Lord – Buffetology Fund

6.45 pm Company presentation from Pebble Beach

7.15 pm Charity Pledge

7.20 pm Company presentation from Mailbox

7.40 pm Melwin Mehta and LeoInvestorUK – Soap Box Are cheap bids stealing good British companies….and are Boards protecting shareholders?

8.00 pm Company presentation from Accesso

8.30 pm Mello BASH – Jack Brumby and Gareth Evans

Keith Ashworth-Lord

“Ask Keith Anything”! For the best chance of getting a question asked – e mail us now at info@melloevents.com and we’ll try and ask it on the night.

Keith is a Chartered Fellow of the Chartered Institute for Securities & Investment, having formerly been an individual member of the Stock Exchange, and he holds the Investment Management Certificate of the United Kingdom Society of Investment Professionals.

Prior to setting up the business and the UK Buffettology Fund, he was a self-employed Consultant working with a variety of stockbroking, fund management and private investor clients. His work has been rewarded with the accolade of winning three top-three sectoral, and one top-ten general, Thomson-Reuters StarMine stock-picking awards in 2008, 2009 and 2010.

Keith experienced investment epiphany in the 1990s when he discovered the achievements of ‘The Superinvestors of Graham-and-Doddsville’. This group of successful investors drew their inspiration from the father of securities analysis, Benjamin Graham. They consistently outperformed the Standard & Poors 500 stock index year-in, year-out, despite having very different individual investment styles.

The common factor was their investment compass where Ben remained true north. Names such as Walter Schloss, Tom Knapp, Bill Ruane and Rick Guerin hardly register in most UK investors’ minds but they are certainly ‘superinvestors’.

Two better known superinvestors are Warren Buffett and his investment partner, Charlie Munger. Keith has had the privilege of meeting these doyens of our industry on two separate occasions in Omaha, Nebraska. In addition to Graham, the influence of Philip Fisher can be found at work with Buffett and Munger. Learning from these masters transformed Keith’s understanding of investment philosophy and with it, his investment performance.

Company Presentation – accesso Technology Group plc

accesso Technology Group plc is an AIM listed company (AIM: ACSO). We have active subsidiary companies in several countries including the USA and Canada and generate our revenue from ticketing, mobile and eCommerce technologies and virtual queuing solutions for the leisure, entertainment and cultural markets. Our patented and award-winning technology solutions drive increased revenue for attraction operators whilst improving the guest experience.

accesso Technology Group plc is an AIM listed company (AIM: ACSO). We have active subsidiary companies in several countries including the USA and Canada and generate our revenue from ticketing, mobile and eCommerce technologies and virtual queuing solutions for the leisure, entertainment and cultural markets. Our patented and award-winning technology solutions drive increased revenue for attraction operators whilst improving the guest experience.

As Chief Executive Officer at accesso, Steve Brown leads the day-to-day operations of the company.

Like many attractions industry veterans, Brown’s early theme park career began during college as an hourly employee at the Walt Disney World Resort in Orlando. After a break to pursue his MBA, he returned to Disney where he held a variety of roles with increasing responsibility in financial planning and pricing strategy including development of revised multi-day admission offerings to incorporate the opening of Disney’s Animal Kingdom. In 1999, Brown was named Director, Walt Disney World Ticketing where he led all aspects of the Resort’s ticketing process across its nine gated attractions including pricing strategy, fulfillment operations, training and financial management.

In 2002 he was named Vice President, Revenue Management for the Disneyland Resort in Anaheim, California. Brown successfully drove dramatic growth in park admissions and hotel revenues through significant changes to strategic and promotional pricing, the introduction of new ticket options and by leveraging technology to expand sales distribution channels. In this broad-based executive role, he held primary financial accountability for the Resort’s hotel and ticket revenues, led all promotional and strategic pricing efforts, and managed the attendance forecasting and visitation research functions. In 2005 his role was expanded to encompass line-of-business responsibility for the Disneyland Annual Passholder program including acquisition and renewal marketing, passholder experience optimization, CRM and pricing strategy. Brown’s contributions were key to the Disneyland Resort’s 2005 – 2006 record financial performance during the celebration of the landmark attraction’s 50th anniversary.

Prior to joining accesso, Brown served as the corporate Vice President of Ticket Strategy and Sales for Six Flags. While at Six Flags, he led a 220-person sales force responsible for driving nearly 35% of the company’s admissions revenue. Brown championed an overhaul of the company’s eCommerce process, which doubled the already significant online sales and established Six Flags’ national partnerships with major distributors including Expedia, Travelocity, Best Buy Reward Zone and Costco. He led a comprehensive, research-based review of the company’s ticket pricing and developed the strategic plan for 2007 price adjustments across the company’s North American theme parks and water parks. The implementation of this plan contributed significantly to 2007 attendance growth and the company’s positive cash flow results for the first time in its history.

Brown received his MBA from the Goizueta Business School at Emory University in Atlanta and graduated with a BS in Marketing from the University of South Florida in Tampa.

As Chief Financial Officer, Fern MacDonald provides leadership, direction and management to the organization’s global finance and accounting team including responsibility for reporting, budgeting, forecasting, compliance and taxation as well as supporting M&A activity.

MacDonald joined accesso in May 2018 bringing over 16 years of finance and accounting experience from both practice and industry. MacDonald is both a Chartered Accountant and CPA and holds a BA from Dublin City University, Ireland.

Prior to joining accesso, MacDonald spent 8 years with private equity backed company ZeroChaos, ultimately serving as Executive Vice President, Finance, supporting the global finance operations, from their US headquarters, through a period of significant growth and acquisitive activity. Previously, MacDonald was a senior manager with Ernst & Young, serving a series of public and private clients from both the Dublin, Ireland and Moscow, Russia offices.

Company Presentation – Mailbox REIT

![]() Mailbox REIT is a single commercial property investment company which offers shareholders exposure to a prime regional investment opportunity. Following a successful IPO on 14th May of this year, the company is now trading on the Wholesale market of the International Property Securities Exchange (IPSX) with live pricing and liquidity provided by two market makers (WH Ireland and Peel Hunt).

Mailbox REIT is a single commercial property investment company which offers shareholders exposure to a prime regional investment opportunity. Following a successful IPO on 14th May of this year, the company is now trading on the Wholesale market of the International Property Securities Exchange (IPSX) with live pricing and liquidity provided by two market makers (WH Ireland and Peel Hunt).

The Mailbox comprises approximately 698,000 sq ft of primarily office space, with a complementary, ancillary retail and leisure offering, located on a 4.8 acre waterside site in the heart of Birmingham, the UK’s second largest city. Mailbox REIT aims to provide investors with the opportunity to gain exposure to the long dated income streams underpinned by very low-risk high-profile tenants, and performance of a prime, office-led mixed use property. The initial target dividend is in excess of c.7% per year which is targeted to rise to a double digit yield (relative to the issue price of £1 per share) over approximately 3 years. This is supported by a business plan implemented by M7 Real Estate – a leading specialist in multi-tenanted real estate with a proven track record and c. 5.3bn EUR of AUM.

Tony Edgley is the Senior Independent Non-Executive Director at M7 Real Estate. He has 40 years of international and domestic real estate experience both as an advisor and a principal investor.

Tony retired as a partner of Brockton Capital in 2018, where he was a member of a five-man Investment Committee with full delegated authority across three opportunistic funds (c£5.25 billion) for eight years. Tony was responsible for originating and leading c£2.25 billion of multi-sector transactions through the full life cycle of acquisition, asset management, design and redevelopment, leverage, joint venture management and sale.

Before Brockton Capital, he was Managing Director of Jones Lang LaSalle Corporate Finance Ltd where he advised the firm’s global clients on joint venture establishment, M&A, corporate disposal, debt advisory and equity raising. Major clients included Blackstone, ADIA, GIC, HSBC, Lloyds Bank and J Sainsbury.

Tony lived and worked for eight years in New York and helped establish the first global real estate institutional investor club; The Prudential Global Programme.

George is an Investment Manager at M7 Real Estate responsible for M7’s Active Funds, Joint Ventures, Separate Accounts, and Listed Vehicles. George joined M7 in 2017 as an Investment Analyst and assisted with the management of a Pan-European value add commercial real estate joint venture fund with Blackstone, consisting of over 1,000 assets, across 10 million sqm, 9 countries and valued at over €8 billion.

Prior to M7, George spent two years as an Investment Analyst with a family office, based in The West End of London, who specialised in UK commercial and residential real estate investment with over £500 million of AUM. George has a master’s degree in Real Estate Investment from Cass Business School and a bachelor’s degree with honours in Economics, Finance and International Business from Oxford Brookes University.

Company Presentation – Pebble Beach Systems Group plc

www.pebbleplc.com Stock code: PEB

A leading global software business specialising in playout automation and content management solutions for the broadcast and streaming service markets.

Pebble is a world leader in designing and delivering automation, integrated channel and virtualised playout solutions, with scalable products designed for applications of all sizes. Founded in 2000, Pebble has commissioned systems in more than 70 countries, with proven installations ranging from single up to over 150 channels in operation, and around 2,000 channels currently on air under the control of our automation technology. An innovative, agile company, Pebble is focused on discovering its customers’ requirements and pain points, designing solutions which will address these elegantly and efficiently, and delivering and supporting these professionally and in accordance with its users’ needs.

Pebble is a world leader in designing and delivering automation, integrated channel and virtualised playout solutions, with scalable products designed for applications of all sizes. Founded in 2000, Pebble has commissioned systems in more than 70 countries, with proven installations ranging from single up to over 150 channels in operation, and around 2,000 channels currently on air under the control of our automation technology. An innovative, agile company, Pebble is focused on discovering its customers’ requirements and pain points, designing solutions which will address these elegantly and efficiently, and delivering and supporting these professionally and in accordance with its users’ needs.

OPERATIONAL HIGHLIGHTS

• Trading in the year impacted by COVID-19 with customers being slow to make investment decisions impacting orders and revenue

• Encouraging uptake in activity in the first quarter of 2021, with orders up 86% in Q1 2021 compared with the same pre-COVID-19 quarter of 2020

• Implemented cost savings to maintain the adjusted EBITDA above 30% despite COVID-19 headwinds reducing revenue by 25%

• Seamless transition to remote working as the UK Government imposed a series of lockdowns

• Workforce capability maintained with no redundancies or use of the Government furlough schemes

• Reduced long-term bank debt by a further £1m

• Extension to bank loan agreement securing the facility until 30 November 2022

• Re-evaluated the values that underpin the beliefs, philosophies and principles that drive our business; positively impacting our employees’ experiences; and enhancing our relationship with customers, partners, and shareholders, culminating in a re-brand for Pebble, including a new website: www.pebble.tv

OUR LOCATIONS

The business is run through the main operational site at Weybridge in the UK. It trades in the US as Pebble

Broadcast Systems Inc and the rest of the world as Pebble. Our Group head office is located in Weybridge, UK

Peter joined the company in 2013, bringing more than 22 years of broadcast industry, financial leadership and executive management experience. Since being appointed as CEO in January 2018, Peter has been instrumental in improving both the short-term short operational performance of the organisation and longer-term growth prospects of the business. Peter’s passion for evolving a company culture based on the foundation of employee and organisational alignment has led to the creation of a clear set of company values. These values are consistently lived across the business in the way we work and behave. This has resulted in a positive and motivated company culture that encompasses our employees’ well-being, ability to function effectively, and career success achieved through aligned performance.

During 2020 Peter successfully steered the business through the COVID-19 pandemic, rapidly leading the highly effective organisational shift to remote working whilst ensuring that focus was not lost on the ongoing development of new products and services.

He graduated from Henley Management College in 2011, earning his Masters’ degree in Business Administration. As a fellow of the Association of Certified Chartered Accountants Peter attends training and development courses on an ongoing basis to ensure Continuous Professional Development. Previously, Peter served as CFO of Pro-Bel Ltd where his strong financial skills and management ability played a key role in the management turning the business around and ultimately merging with Snell & Wilcox.

Since joining in October 2020, David has built excellent working relationships both internally and externally. David is a trusted and valued asset to the Group from corporate decision making and forward planning at Board level to the finance function, with expertise in all facets of accounting, financial management and analysis, controllership and governance. As the business grows, David will be instrumental in dealing with corporate fundraising, mergers and acquisitions, and post-deal integration. David spent a large part of his career, from 1999 to 2013, as Group Finance Director with Next Fifteen Communications Group plc, an AIM listed international digital marketing group which, during his tenure,

grew from £23 million to £100 million in revenues. David played a vital role in the growth of the business both organically and through M&A, supporting its international expansion in Europe, Asia and North America.

From 2014 to 2018 David was Chief Financial Officer of PTS Consulting Group Ltd, a VC-backed IT consulting business with revenues of c.£42 million. There, he helped turn the business around with a £1.5 million improvement in EBITDA. Most recently, David has been Group Finance Director to Smyle Creative Group Ltd, a PE-backed creative events business with £27 million revenue, later transitioning to board consultant. Here David secured new funding to complete vital infrastructure investments critical to long term growth and generated cash by streamlining working capital processes.

Mello Soap Box

Are cheap bids stealing good British companies….and are Boards protecting shareholders?

Melwin Mehta invites your comments and questions

Another day and yet another great British business is sold –is corporate governance failing?

This month, we have seen recommended cash bids for Wey Education, Spire Healthcare, Vectura, John Laing and UDG Healthcare.

Click here for more information

Melwin Mehta invites your comments and questions and you may write to him on : mel@sterlingim.co.uk

Melwin is the founder of Sterling Investments and has been the Fund’s portfolio advisor since October 2017. He invests with an ownership mindset and analyses every company like a business. Melwin lays heavy emphasis on management calibre and meets more than 200 companies annually. His 21 year career includes roles in private equity, family office and hedge fund. He is a Bachelor of Engineering, member of the CFA UK Society and holds the IMC.

MelloBASH (Buy, Avoid, Sell, Hold)

Gareth Evans, MD, Progressive Equity Research

Gareth has 20 years’ research experience covering the Technology sector. An Oxford University graduate, Gareth qualified as an accountant before starting his research career covering the Pan European Chemicals sector at the American Investment Bank Donaldson Lufkin & Jenrette (DLJ), later acquired by Credit Suisse. He then moved to cover the Technology sector at ABN AMRO, Canaccord and at Investec for eleven years, where he was Joint Head of Research. Gareth has received numerous awards for his work, including being voted techMark Analyst of the Year. Recognising the gap in the market for good quality research at the small cap end of the market, Gareth founded Progressive Equity Research in 2012.

Jack Brumby, Financial Writer at Stockopedia, including the Small Cap Value Report

I’m looking for compounding investments. I started off in Leisure – a part of the market I still love, but an area where stocks can appear “cheap” for years without going anywhere. It made me realise that valuation is only one part of the puzzle.

Now I sift through a much broader universe of stocks in search of small, high quality operators with large addressable markets, strong and maintainable margins, and clear share price catalysts.

MelloMonday Sponsors

Hardman & Co is a multi-disciplinary financial consultancy and investment research firm, employing highly experienced analysts and professionals with a broad range of capital markets expertise.

Click here for Hardman & Co research.

Progressive introduces you to new investment ideas. FCA authorised and regulated, we provide freely available equity research and connect investors with companies across every sector of the market.

Progressive introduces you to new investment ideas. FCA authorised and regulated, we provide freely available equity research and connect investors with companies across every sector of the market.

Click here to receive our research and be invited to our regular investor events.